Twelve years ago, I wrote about converting my business from an LLC to an S-Corporation. The common wisdom at the time, which is still the common wisdom, is an LLC is an easy way to protect what would normally be your sole proprietorship. This is sorta true. It mostly protects your investors since almost everything you do as a small business also involves your personal guarantee. That's a side issue, as the real problem with the LLC advice is it depends.

LLCs, limited liability corporations, are state entities. The IRS doesn't care about your LLC, and treats it like a corporation, usually an S-Corp. An LLC in Wisconsin, created under Wisconsin LLC laws, is a very different animal than an LLC in say, California, where you'll find my business. An LLC in California is pretty awful. So how has converting to an S-Corp worked out for me?

There is a really obvious good side to the conversion and a painful side that haunts me to this day. The good side is LLC versus corporate fees. If you had an LLC in Wisconsin, my example, you would be paying ... let me get my calculator out ... $25 a year in fees. Whether you gross a hundred dollars or a million dollars, Wisconsin wants their $25. It makes sense in Wisconsin to recommend an LLC. California is a very different, some would say very aggressive, animal.

LLC fees in California are on a sliding scale, based on gross income. This focus on gross income is important, because retail stores make a very high gross and a very low net income. If my buddy in financial services makes a million dollars a year in gross income, his net income might be 25%, or $250K a year. My net income in retail, grossing the same amount of money, at around a 10% average, would be $100K. In fact, for many years, my buddy and I had the same gross sales, and I grew healthily (back) into the middle class while he grew wealthy. It's not what you make, it's what you keep. Anyway, a California LLC would impose the same exact fee on both of us, $6,000 a year. Taxing on gross revenue is unfair.

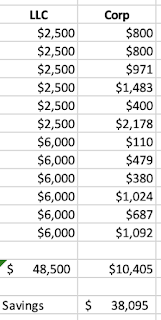

So how much money did converting to an S-Corp end up saving me? Over time, my S-Corp profits grew healthily, with a couple years of corporate fees rivaling LLC fees. However, we also had years where we had losses, despite over a million dollars in gross sales. In those years, my LLC fees would have been full boat, $6,000, but instead I paid a hundred bucks or so. In no year did my S-Corp fees exceed LLC fees. Overall, I saved $38,094 over the past 12 years by converting my LLC to a corporation.

There was a painful down side. There is the constant problem that continues to rear its head, and that's the relationship with existing businesses, and even the federal government, who initially have your LLC on record. You would need to change your name and move to avoid seeing the dreaded LLC pop up from time to time. Any relationship you've had is likely to refer to you as an LLC at any time, which also means referring to your old EIN number, corporate dead naming.

When I applied for an emergency loan from the SBA, they initially had trouble finding my business, because their records showed an LLC, while I had been an S-corp for ten years. Could you imagine being denied funds because of this technical irritation? It was an emergency, so they waved it off, giving my S-Corp a loan despite their records showing an LLC.

My payroll company and alarm company likewise LLC me, despite asking them to stop, and I just recently created a new S-Corp bank account. Under banking regulations, changing EINs requires a brand new account. That is reason enough to be cautious. It took me 11 years to comply with that one, and only after my account was hacked.

Changing to an S-Corp was a big hassle, but was it equal to a brand new car worth $38,094 big hassle? Oh yeah. Of course, if the SBA had denied me a loan and I had gone out of business, mmm, not so much. The only way to be sure you've eliminated your LLCishness is to burn it with fire. Open a new bank account, change payroll companies, move somewhere else. It's the witness relocation of business entities. But you can't argue with $38,094, especially in a state that taxes my barcode scanner.